Risk analysis of financial instruments and investment portfolio management

An advisor platform that helps investors be fearless.

An advisor platform that helps investors be fearless.

What we did

Creating a new report system.

Guiding the product lifecycle.

Our Goal

Riskalyze, being one of the first biggest projects in MasterBorn, provided us with opportunities to grow and learn. As a team, we took our first steps in the FinTech industry. Riskalyze trusted us to create a brand new reporting system.

Our team cooperated closely with Riskalyze's technical team (they even came to meet us in Wrocław)! A designated product owner attended our retrospective meetings, ensuring that we were always on the same page.

This professional reporting system exceeded client expectations and continues to support financial advisors in identifying investment risk.

It was a pleasure to work on a project stable enough that the entire team was comfortable with it. It allowed us to explore new solutions and get every detail right.

MasterBorn Tech Team Lead

The Outcome

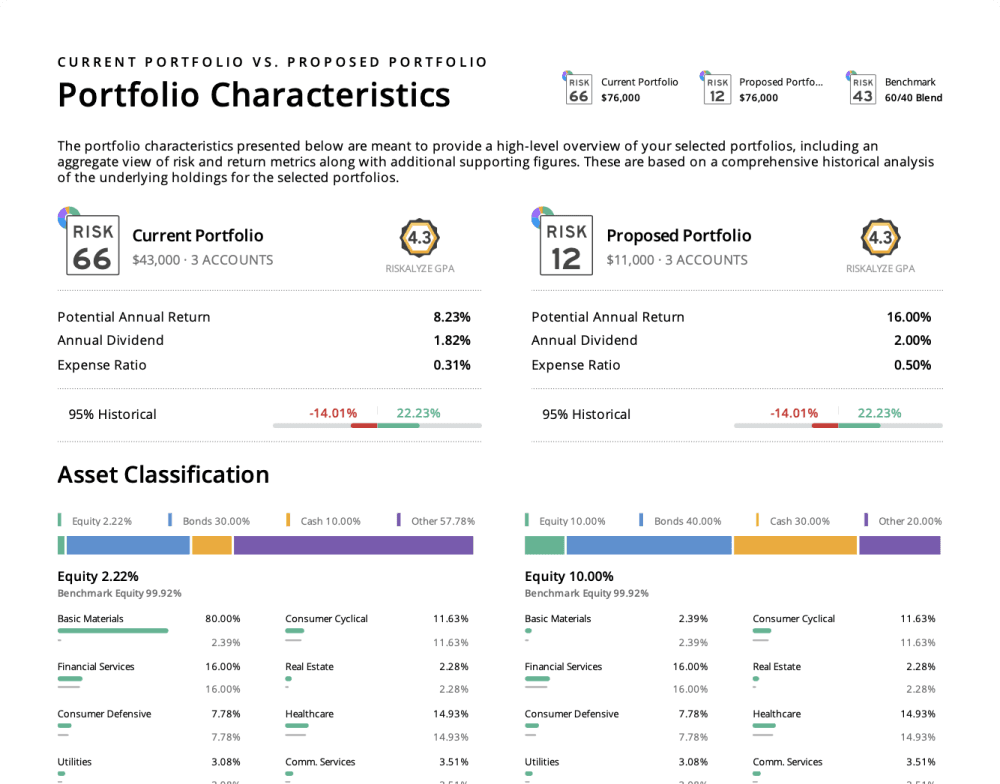

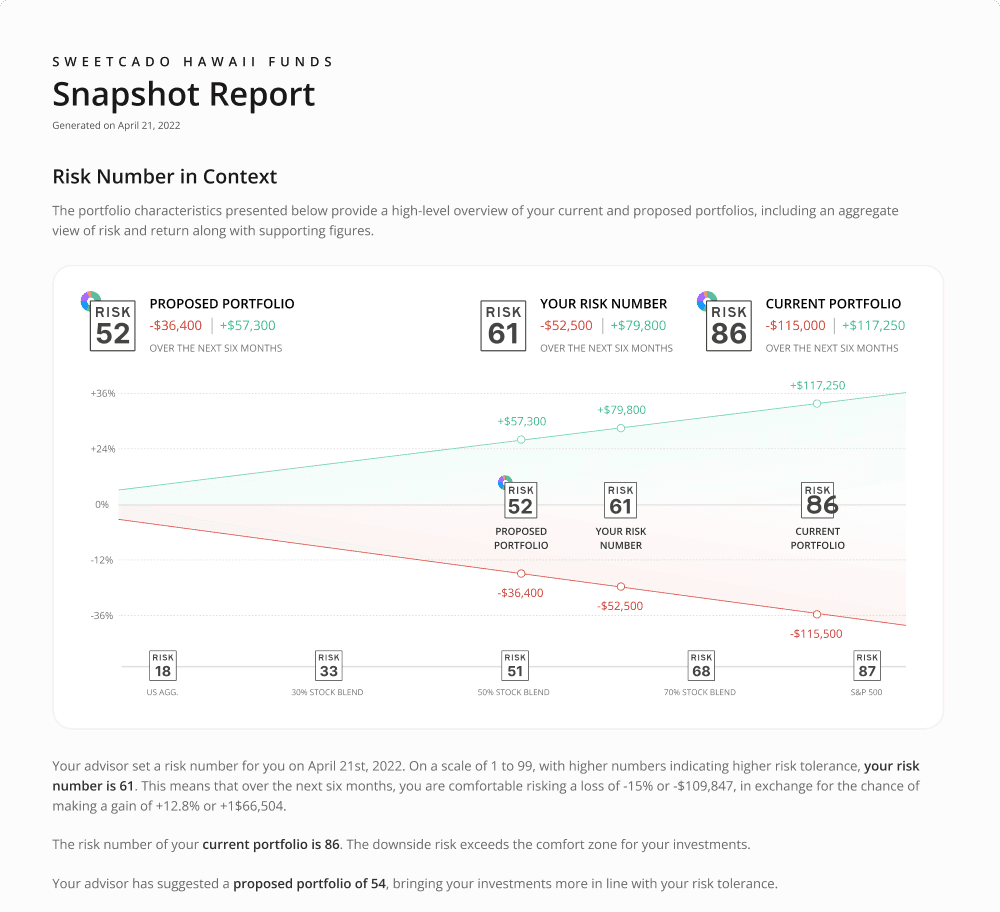

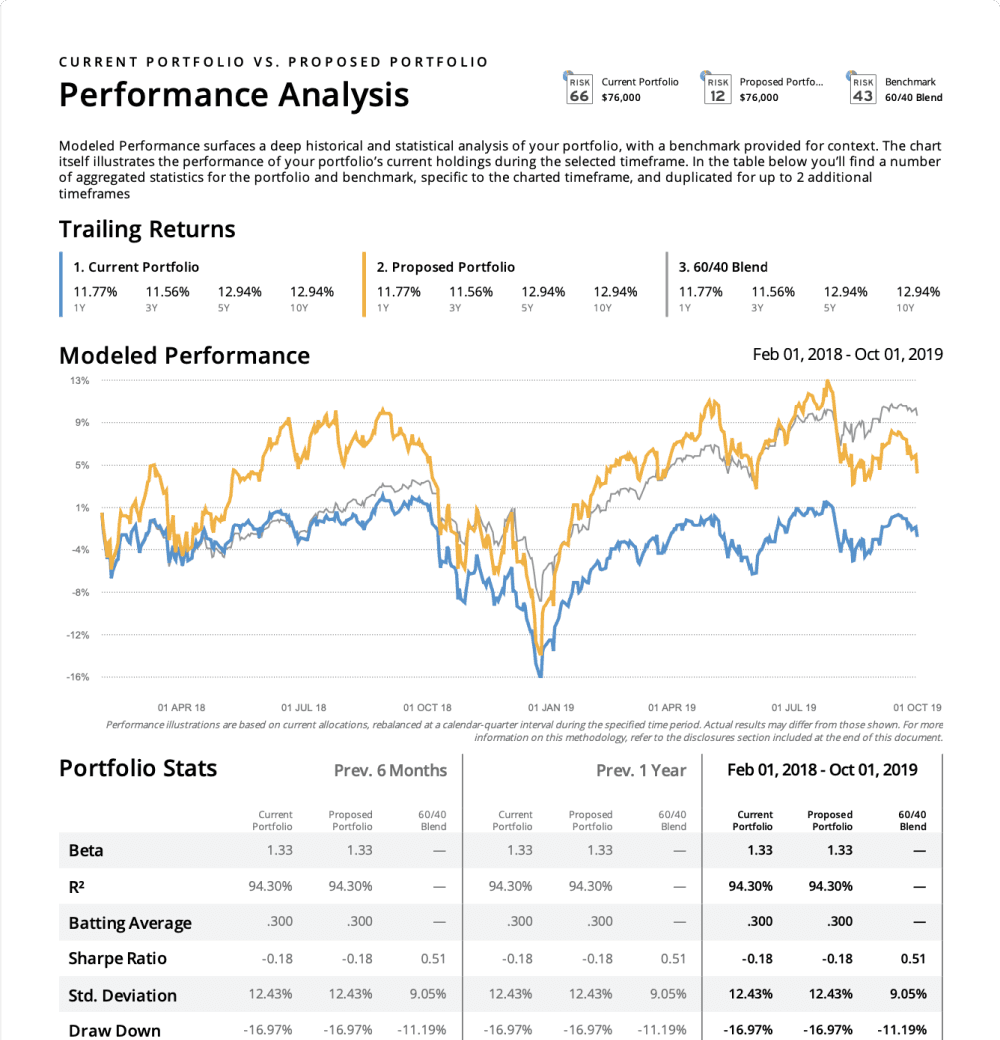

Based on the existing system that determines investment risk, we developed multiple advanced reports — graphs, summaries, statistics, etc. We took data straight from the Riskalyze system and packed them into clear and user-friendly PDF files.

A well-coordinated team of professionals

Collaboration on the code (code reviews)

The client was impressed with how fast end efficient we work

What We Learned

We faced several hurdles while working on Riskalyze. First of all, it was an unusual use of React (and Puppeteer)! We also put a lot of effort into PDF conversion, because not all functionalities could be used, there were no interactive elements, and we had a lot more unexpected factors to take into account. But unpacking these challenges made us work together to come up with unique solutions.

It was also quite a challenge, and it boosted our area of expertise.

CTO MasterBorn